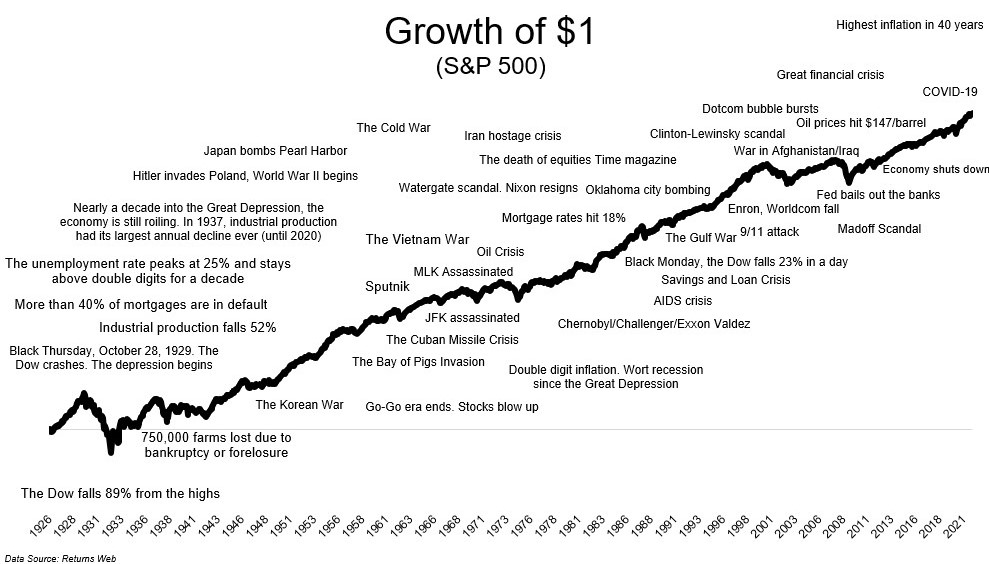

They are commonly referred to as the most expensive words in investing: “This time is different.” And it can be so tempting to be convinced the doom and gloom of current events and economic forecasts are unprecedented and there’s no way the economy or the stock market will ever grow over the long term from here. Proponents of this mindset often brush aside history as any guide to how potentially terrible circumstances will persist and certainly worsen from here and assume “this time is different.” They scoff at charts, like the one below, showing all the historically bad news events laid out as a timeline against the consistent multi-decade grind higher of the US equity market. They dismiss the “faith” in future markets as pollyannish and naïve and provide a mountain of current data pointing to inevitable economic catastrophe.

But one could argue the naïve or unsophisticated viewpoint and the ”leap of faith” is really one borne by the doom-sayers. In short, they are the ones that need to be proponents of scenarios which fly in the face of evidence going back over one hundred years. Just looking at the growth of US equities over almost a century, despite all the challenging events, it’s clear something is going on. Something is inherent in our system that allows for this long-term growth trend overcoming the near-term challenges that face our world every year. In reality, the investors that have built the most wealth over these decades are those who have taken the view that “this too shall pass” and have kept their investment, savings, and wealth plan intact despite the headlines advising to sell out and run for the proverbial exits.

Why It Could Be Different This Time

To be fair, it is tempting to lose perspective and suffer from the damaging effects of myopic interpretation of current events and the even more damaging extrapolation forward. It’s clear that, in 2023, there is certainly no shortage of things to be concerned about as the list seems endless:

- Potential for an economic recession

- High federal debt levels and entitlement spending

- Inflation

- A divided populace

- Government corruption

- Geopolitical fires everywhere around the world (Ukraine/Russia, Middle East, China / Taiwan?)

- Uncertainty around the 2024 US elections

There are no certainties in life (except death and taxes, as noted by Benjamin Franklin) so it might actually be different this time, and we make no predictions or guarantees about the future, but we use history and data as our trusted guide. We think predicting a collapse of the civilized world would be going much further out on a limb when evaluating what’s driving the historical data and the long-term trend line up and to the right.

Why It’s Likely Not Different This Time and This Too Shall Pass

What can be helpful is a reminder of factors that actually drive stock returns over the short and long term. In the short term, it’s emotion-based reactions, but over the longer term, math tends to win. This is why it is critical to break down the fundamental reason stock prices, in aggregate, tend to go up over the long term: because companies’ profits and cash flow go up. In fact, over the last 50 years, cash dividends alone are up over three times the inflation rate.

So, what drives cash flow? Innovation, adaptability, great management, solid business models, prudent judgment by some of the best resource allocators in the world -- those who create, grow, and manage companies for a living. It’s easy to look at stock tickers or mutual fund/ETF funds on investment statements and forget that behind those numbers and charts are smart, hard-working people motivated by maintaining and growing profits. These future profits, cash flows, and dividends discounted back today are what constitute stock prices.

History shows, when human nature is left free and unshackled, progress is inevitable. Even recent history demonstrates how companies can evolve within decades: Apple went from selling Macintosh computers in the 1980s to iPhones and iPads. Amazon went from selling books online to selling everything plus developing a massive web hosting service business. Facebook, Google, and so many of today’s largest companies didn’t even exist 20-25 years ago!

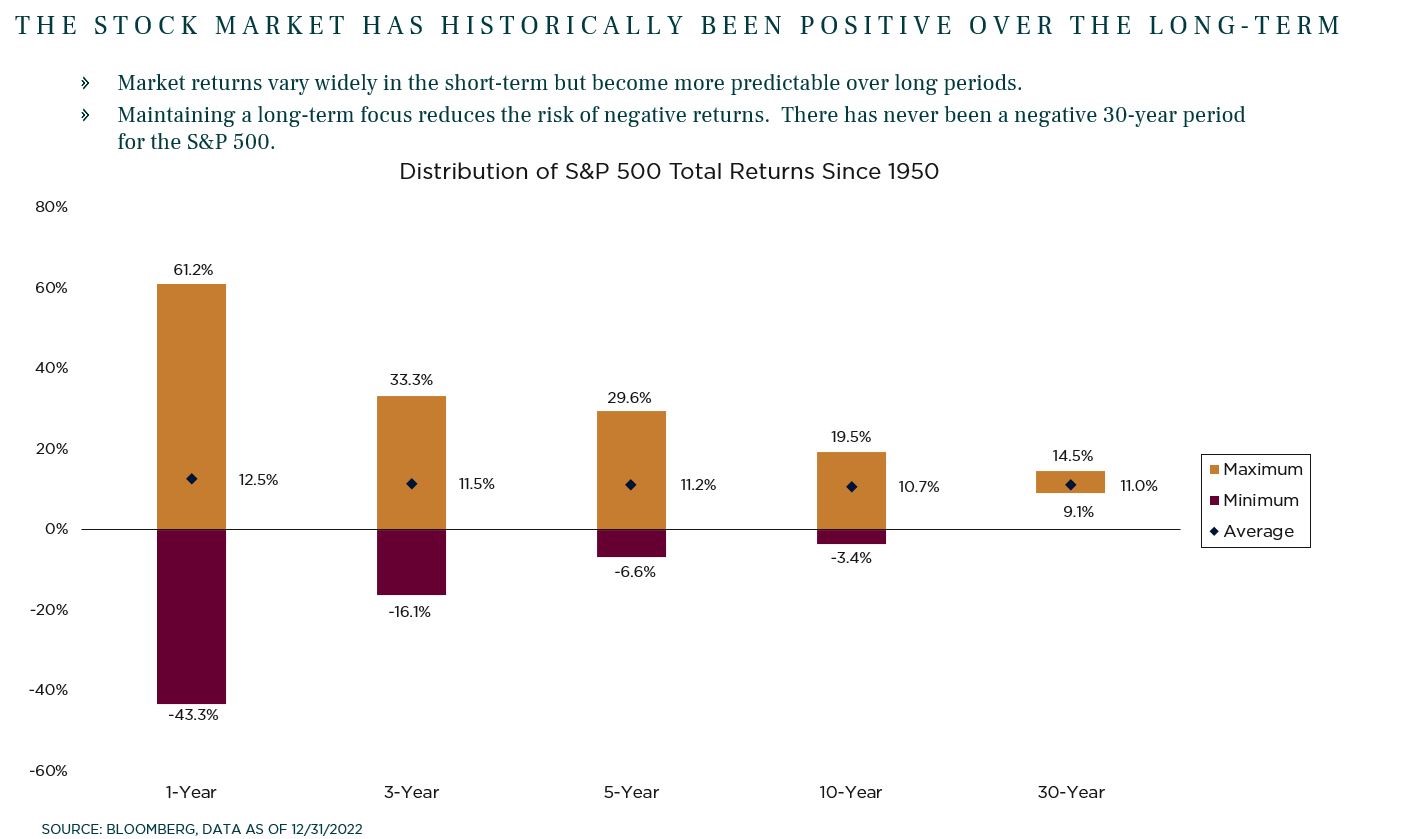

Of course, the problem of near-term volatility can blind even the most steadfast investor. Since 1950, the S&P 500 has been up as much as 61% in a single year but down as much as 43%. However, over three, five, ten, and 30-year periods, these returns smooth out as the unshakable math of innovation-driven earnings growth eventually overwhelms emotion-driven, knee-jerk reactions to the short term.

Bottom Line

Fading memories and age limit our ability to accurately recall exactly how we felt during the trying circumstances with each passing decade. Looking back to very recent history with more vivid recall can be helpful as a case study in economic and market resiliency. Between January 1, 2018 and September 30, 2023, the S&P 500 endured three bear markets with pullbacks of 20% (end of 2018), 34% (March 2020), and 25% (September 2021) due to Covid, rapid interest rate increases, and many other challenges. So, what has the S&P 500 returned in total during that period? The S&P 500 is up 60%, which is 8.5% annualized, just under the 50-year average of 8.7%.

Was it “different” even then? Is it “different” now? Or will “this too shall pass” be vindicated yet again?