With so many recent headlines surrounding the debt ceiling, inflation, and interest rates, chatter around a global weakening of the US dollar has ramped up along with concerns by some investors. Financial pundits, some politicians, and Tik Tok “experts” seem to be amping up the hyperbole lately with increasingly dire predictions of the decline of the United States’ clear advantage of being the world’s reserve currency. Phrases like “the dollar is collapsing” certainly make for clickbait and potential political points, but is it really based on factual data and a realistic view of the world? And even if this is a scenario trending toward reality, what would be the implications for savers, investors, and wealth planning for the future in the US?

Suffice it to say, it is impossible to summarize all the moving pieces of this topic in a short article as currency discussions are extremely complex and involve nuanced economic concepts and geopolitical crosswinds, with a multitude of unpredictable moving pieces. In addition, massive shifts in global currency usage have historically played out over decades and centuries, not months or years. For this reason, we believe time and resources best serve clients by integrating evidence-based investment, tax, estate planning, and cash flow strategies framed in domestic currency terms. However, given the sensitivity to the topic and the concerns of some, we thought it appropriate to provide some instructive data and real-world context and implications for pre-retirees and retirees working toward their families’ financial goals.

US Dollar Dominance Defined

Despite what the hand-wringing headlines might indicate recently, the US Dollar still serves as the world’s “reserve currency” – by a wide margin. In broad terms, this means that the US currency is utilized as the most reliable means of exchange across the world to facilitate commerce with the least “friction” possible. Across the globe, no currency is more trusted or relied upon to be stable in value and liquidity (availability for trade). Again, the reasons for this could fill a textbook, but, in essence, the US remains the wealthiest, most technologically innovative, politically stable, and militarily powerful nation on earth – despite the consternation gripping the country these last several years.

So, the questions to ask for those doubting the dominant usage of the US dollar are: How dominant is the US dollar currently and, if there was a shift, what else would be used?

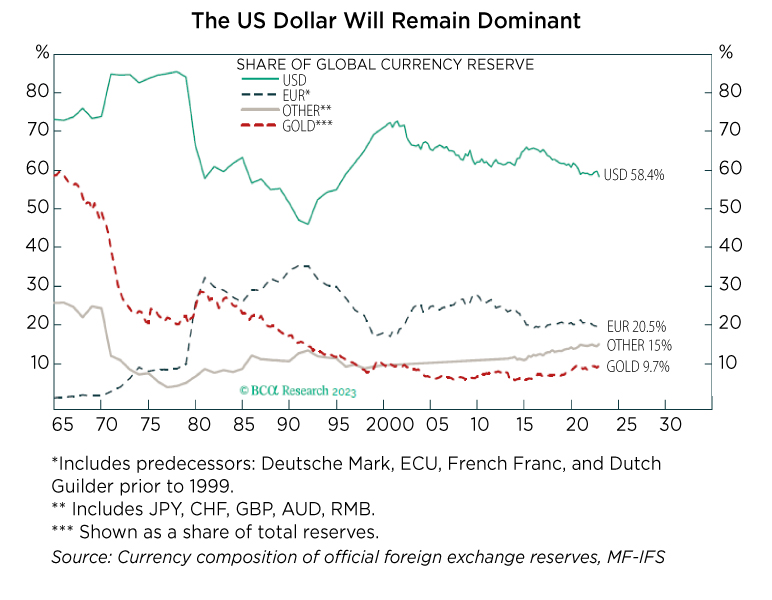

Despite our country’s issues, it’s imperative to remember that any reduction in the substantial usage of the US dollar in the global marketplace must be backfilled or substituted with another currency or means of exchange. What other currencies are candidates? Some say the Euro, Chinese yuan, or a new currency “bloc” of multiple countries, but the data shows there is much ground to make up to even come close to parity. As noted in the chart below, published by BCA Research, the US Dollar remains dominant as a percent of total currency reserves, and while it’s trended down from the 1960s, no other currency is reserved even half as much. Relative to the US, recent competitors (like China) still have an unreliable and unpredictable communist-based government that has yet to fully liberate its private sector or capital controls, maintains massive debt levels (higher than the US as % of GDP), and is facing substantial demographic headwinds unlikely to reverse in the decades to come.

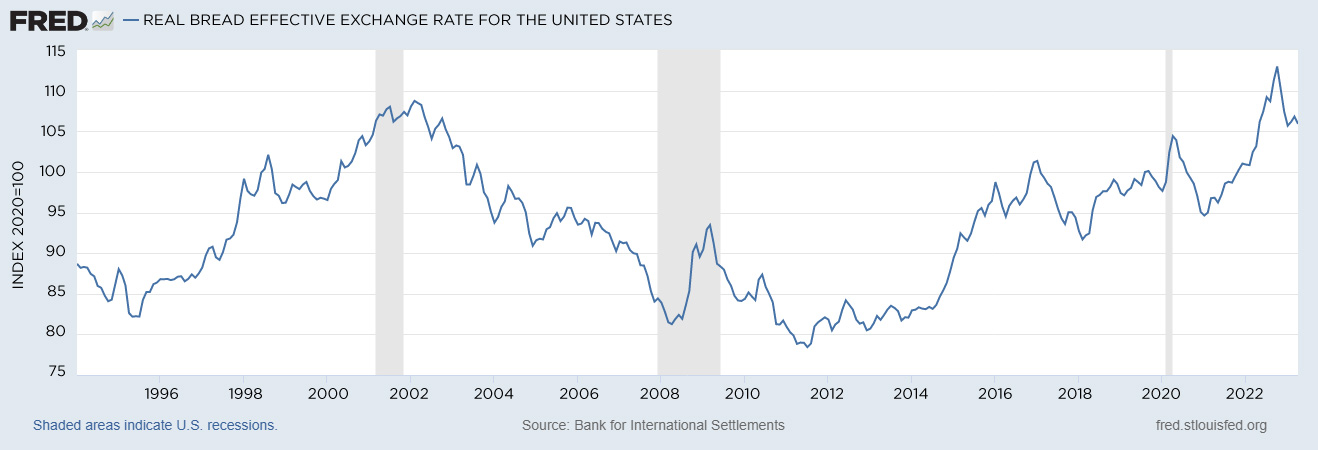

Looking at it another way (as noted in the chart below from the St. Louis Federal Reserve), how has the value of the US Dollar -- relative to a basket of all other currencies in the world -- trended over the decades? Has the recent inflation in the US reduced our currency’s value relative to the rest of the world? Obviously, not as relative to other currencies, the US Dollar has strengthened when compared to 30 years ago. Again, all currency discussions must factor in the relative value to other countries, not the absolute nature of domestic purchasing power. Clearly, the inflation we’ve endured recently is not unique to American citizens when viewed through a multi-decade landscape, and despite all the talk of a devaluation of the US Dollar, it’s clear this has not occurred relative to other currencies on a broad basis.

What Are the Implications for Wealth Planning & Investing?

Unless a family has liabilities denominated in foreign currencies, which would be more difficult to pay back with a weakening dollar, prudent wealth planning should be more concerned about the US dollar’s purchasing power of goods and services in the US. Said differently, investors and savers should be more concerned about the cost of monthly living expenses and less concerned with monitoring currency reserve trends. This means designing, executing, and sticking to an investment strategy that accounts for inflation assumptions by maintaining the proper balance of growth assets (equities) along with stable assets (cash and fixed income) to fund needs or goals in the near term. Commodities such as gold, oil, or other precious metals are often considered to be great hedges against inflation, but, over the long term, these asset classes’ history of hedging against weakening currency is inconsistent, at best, and should be reconsidered carefully before allocating them to a large portion of a portfolio.

Over time, we believe equity investments in well-run companies still serve as the best hedge against inflation with these companies’ ability to innovate, add value, and raise prices on their goods and services. This ability to keep up with inflationary trends has, over decades, manifested in higher share prices and increased cash dividends, which, together, have outperformed increases in inflation over the last hundred years or so in the United States.

In short, concerns about a weaker US Dollar should be redirected instead to focus more on how much groceries cost each week, rather than how much more a European vacation might cost or if China will form a currency bloc with Brazil.

Bottom Line:

There’s no argument the US has enjoyed the advantages of being the world’s reserve currency for decades. These advantages include the ability to keep interest rates relatively low, geopolitical influence over other countries, stability, and increased demand for US goods and services. We think concern, worry, and consternation around this topic, while troubling, should not be the primary focus of a family’s wealth plan. In short, the US currency maintains a substantial degree of dominance on the world’s financial stage, and it would likely take decades for this geopolitical landscape to change. Instead of focusing on US currency relative to other countries, we think families should focus on tax efficient investment and wealth plans that help maintain purchasing power of assets relative to domestic goods and services, which provides a more real-world impact on day-to-day life. Even better, keeping the focus at home doesn’t require trying to diagnose China’s demographic trends or European interest rate policy!