In our wealth planning discussions with clients, there’s an old and somewhat morbid joke that comes up when helping them with the vexing question on when to claim their Social Security benefits: “If you tell me the exact date of your death, I’ll tell you exactly when to claim your Social Security!” Of course, the exact dates of death are completely unknowable, which is part of the not-so-funny joke. But the joke is intended to illustrate just how difficult it is to pinpoint an optimized strategy when one of the main, driving variables is completely unknowable.

Social Security claiming is just one of the many aspects of retirement cash flow planning influenced by unknown longevity. So it was interesting to come across a recent article in the Wall Street Journal, which illustrated how peoples’ assumptions on this key factor likely need to be adjusted or at least reconsidered given their outsized impact on the plan. This is critical because there’s just no escaping the fact that the “success” of a retirement cash flow plan has an infinite number of positive outcomes (i.e., amount of assets left to heirs at death) and only one massively negative outcome – running out of money.

With that in mind, we are strong advocates for utilizing tools which factor in the latest actuarial data as a critically important best practice to improve the accuracy of a multi-decade retirement cash flow trajectory. No projection is perfect, of course, as longevity is just one of the many variables that are unknowable. However, by studying and utilizing more accurate assumptions, retirees can have a better understanding of the risks of running out of money so the factors we CAN control can blunt the risk of the factors we cannot.

Reality Check on Longevity Assumptions

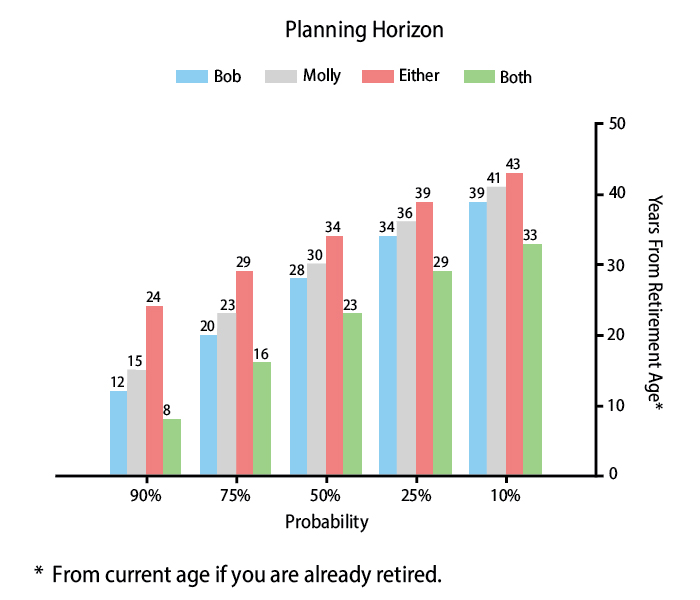

The article made several interesting points with respect to people’s perspectives on how long they think they will live. Using the latest actuarial data on lifespans (which insurance companies use to price insurance and annuity contracts), it’s a distinct possibility that people will live longer than they currently assume. As architects and stewards of retirement cash flow strategies, we think it’s critical to factor in and update this key planning assumption. As noted in the Wall Street Journal article, it’s now easier than ever to use data from the American Academy of Actuaries and Society of Actuaries as there is a publicly available web-based tool which can drive home and personalize life expectancy. This Actuaries Longevity Illustrator can be accessed for free at https://www.longevityillustrator.org/ -- and it’s very simple to navigate. Using this tool, we find a sample married couple born in 1963 who are non-smokers in excellent health, there is a not-so-insignificant chance one or both would be alive well into their 90s!

Source: https://www.longevityillustrator.org/

To help translate this chart, the data shows a 25% chance:

- Bob will live 34 years to age 94

- Molly will live 36 years to age 96

- BOTH will live at least 29 years to age 89

- ONE of them will live 39 years to age 99

As with many online calculators, you can slice-and-dice the data with many different variable adjustments and the results must be taken with a grain of salt as these are merely estimates. The main point is today’s newly-minted retiree, around age 60, should be planning for at least a 35-year retirement, and likely even longer.

Planning Implications

Clearly, longevity is just one factor among many, and we only have limited influence with a healthy lifestyle and good habits. Genetics and random chance are at least as impactful and cannot be controlled. However, factors retirees CAN control also have significant influence on the success of a retirement cash flow plan. Realizing this, we believe the most prudent approach is to assume a life expectancy beyond what the actuarial data shows and then layer in calculations for variances in planning assumptions. These include:

- Retirement Date: If not already retired, it’s obvious to most that the later the retirement, the better chance of having ample retirement funds. It is surprisingly striking to see just how even one more working year can significantly impact the success of the plan. If nothing else, it’s a buffer against the unknowable longevity variable.

- Social Security Claiming: Also an important consideration (as already referenced), are the benefits at various claiming ages combined with the impact on the existing portfolio, spending, tax rates, and legacy goals. Some call Social Security the ultimate longevity insurance (a government-backed, inflation-adjusted annuity) and making the right call on when to claim is a crucial decision for retiree cash flow.

- Spending & Inflation Assumptions: Much like the retirement date, even slight increases or decreases in assumed spending can be surprisingly impactful. Add in a slight change in inflation assumptions (which is even more difficult these days) over a 30- or 40-year retirement, and the projected outcomes can vary widely.

Avoid “Set-It-And-Forget-It”

Broadly speaking, we believe it’s best to assume longevity of at least age 100, barring any known health issues, when projecting out a multi-decade retirement cash flow model for those about to retire or recently retired. Of course, we also need to incorporate in all the aforementioned factors in addition to lifetime goals for charitable intentions, travel, and gifts to heirs. However, these plans are anything but “set it and forget it” as each variable changes by the day. Portfolio volatility along with changes to spending patterns, goals, health, births, deaths, and marriages are all factors that redirect the trajectory of the projection. This is why the retirement cash flow plan should be updated at least annually and even more frequently if feasible.

Bottom Line:

Envisioning and discussing our ultimate demise is certainly uncomfortable. But confronting this question head-on and using updated data and conservative assumptions is critical to the success of a strong retirement cash flow plan. Like any 30+ year projection, a long-range retirement plan will certainly stray from the forecast with each passing year. By using conservative (and realistic) assumptions, starting early, and maintaining flexibility in the factors we CAN control, we believe retirees can sleep a little better, knowing their plan is likely to comfortably fund even a triple digit lifespan!