Given all the tumultuous events in our world over the last couple of years, it’s a challenge not to sound like a broken record when attempting to provide perspective on the investment landscape. Unfortunately, headlines the last few years have often employed adjectives and phrases like “unprecedented” and “once in a lifetime” and “black swan event” when describing the environment for making decisions on portfolios and asset allocation. It seems as one event recedes (Covid-19 pandemic), another event (Russia-Ukraine war) steps in and takes up where the previous event left off, never providing investors any semblance of a break from the uncertainty.

Adding to this turmoil the past several months, investors are now tasked with factoring in the geopolitical events with confounding macroeconomic crosswinds. Specifically, bearish indicators are flashing such as Fed tightening and balance sheet reductions, a reduction in fiscal stimulus, persistently elevated inflation, inverting yield curves, and potentially slowing earnings growth. These are counterbalanced by bullish indicators such as the strong labor market, continuation of historically accommodative “real” interest rates (when accounting for inflation), a scalding hot housing market, and relatively healthy consumer balance sheets. All this uncertainty can lead to an acute sense of anxiety about the near-term and longer-term outlook for stock and bond returns. This uncertainty has taken its toll on year-to-date returns in major asset classes as the broad-based stock and bond indexes have retreated from all-time highs thus far in 2022.

All this being said, if market timing was already difficult if not impossible, this is certainly not the time to try one’s hand at predicting what’s going to happen and how stocks, bonds, and other asset classes might respond to so many conflicting factors. We have always held to the philosophy of taking the long view on allocating client capital, not trying to time when to “get in” and “get out” of stocks or bonds based on our interpretation of current events. The historical evidence is overwhelmingly clear these attempts usually cause more harm than good. Instead, we employ a sound diversification and consistent rebalancing strategy, time-tested principles foundational to success over the long term.

Since we can’t control and can’t predict what’s happening in the world and how it will impact portfolios, what can we do? We can focus on wealth management strategies and tactics that make sense in any environment. One such tactic is to find opportunities to save money on taxes. One way to do this is to employ a tax-loss harvesting strategy in taxable investment accounts. This not only provides tax savings but also helps with other key aspects of portfolio management. Think of it as a good spring cleaning of the portfolio!

Making Lemonade Out of Lemons – Loss Harvesting in Taxable Accounts

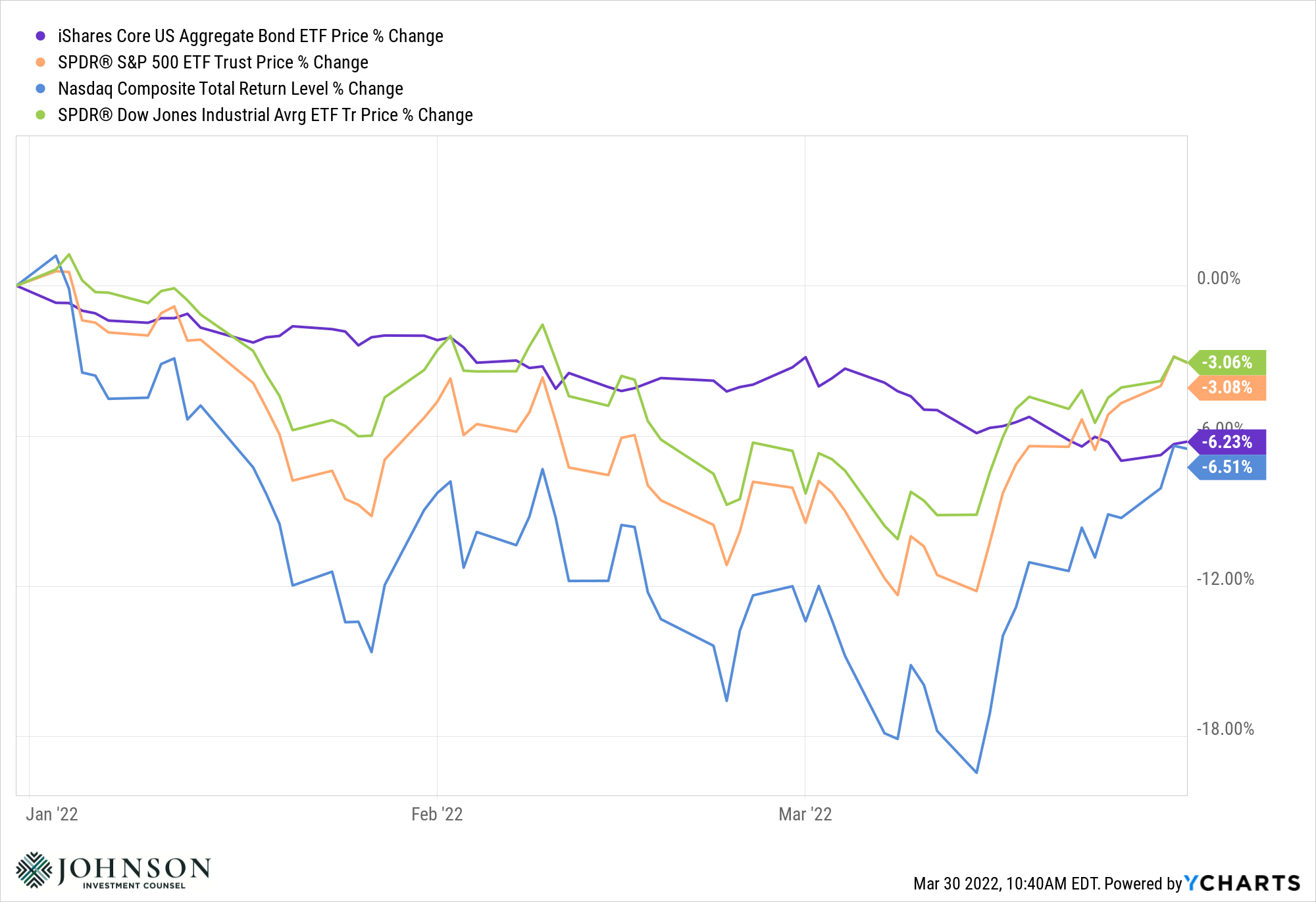

From a market perspective, the first several months of 2022 have started off poorly as noted by the chart immediately below. The benefits of diversification have not been on display in the short term due to all the nuances of the current environment described above. Historically, stocks and bonds tend to have a negative correlation, meaning when stocks are up, bonds can be down (or up less) while falling stocks are usually counterbalanced by higher returns (or down much less) from bonds. While this dynamic still could play out for the year as a whole, the early stages of 2022 have not been so kind.

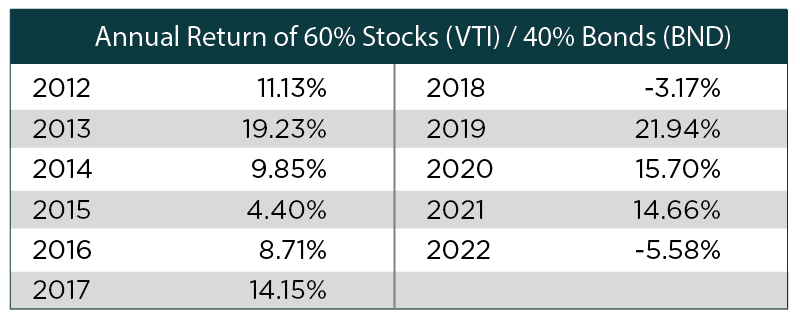

Simultaneous declines of both stocks and bonds are rare for a balanced portfolio as indicated in the historical annual returns table below. Using the Vanguard Total Stock Market ETF (Ticker: VTI) and the Vanguard Total Bond Market ETF (Ticker: BND) as a proxy for the 60% stocks / 40% bonds portfolio, this mix has provided relatively strong returns in the 10 years prior to 2022. But this mix is down about 5.6% year to date.

Such downturns provide an opportunity to analyze holdings and make lemonade out of the lemons via tax loss harvesting.

Tax Loss Harvesting Considerations

Tax loss harvesting does have its complications and certainly requires a sharp eye and solid knowledge of current and future tax status. In addition, it’s important to emphasize all these considerations apply to taxable accounts, not retirement accounts such as Traditional IRAs, 401(k)s, 403(b)s, and Roth IRAs. Here are some key considerations:

- Opportunity to Realign the Portfolio: Capital gains taxes on the sale of appreciated assets can be a constraint on portfolio management. In down markets, this potential roadblock can be reduced or eliminated by selling securities at a loss (or smaller capital gain) to reduce or eliminate out-of-favor securities as well as realign the portfolio to asset allocation targets.

- The Math is Important, but Be Mindful of Holding Period: By selling at a loss, investors can either deduct a maximum $3,000 / year from their income (in aggregate) for joint filers or they can offset other realized capital gains in the portfolio during the year. If the aggregate realized capital losses exceed $3,000, the remaining loss above $3,000 can carry forward to offset gains in future tax years. The holding period is important. Securities held over one year are considered long-term gains or losses, while a holding period of less than a year is considered a short-term gain or loss. The interplay between these two is important as a specific calculation determines what gains offset what losses.

- Wash Sale Rule: When executing on these transactions we are mindful of the wash sale rule. Essentially, a taxpayer cannot sell at a loss and then turn around and immediately buy a “substantially identical” security right away. If the wash sale rule is violated, the capital loss is disallowed, and the disallowed loss is added to the cost basis of the new asset. This essentially preserves the tax benefit but defers the realization of the benefit until the new asset is sold. What constitutes “substantially identical” is subject to interpretation and caution is necessary.

Bottom Line

Foundational to our investment approach is the belief that successfully timing the market is virtually impossible over the long term. However, tax timing is much more predictable. Locking in tax-deductible losses or reducing taxable gains uses empirical facts (current prices and tax law) and can add real value to the portfolio. Capital loss harvesting can help take the sting out of the red ink on portfolio statements, making the market rebound more enjoyable knowing tax bills will be better as a result of the spring cleaning.

Published 04/17/2022

Johnson Investment Counsel does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.