As we close 2025 and flip the calendar to 2026, we can look back at generally strong markets facing the cross-currents of economic and geopolitical uncertainty. These factors and scenarios have one thing in common: they are out of our control. Realizing this, we created a financial “checklist” for tactics we do control, which could have a positive effect on cash flow, balance sheets, and peace of mind as we close the book on another year.

Investment Portfolio Checklist

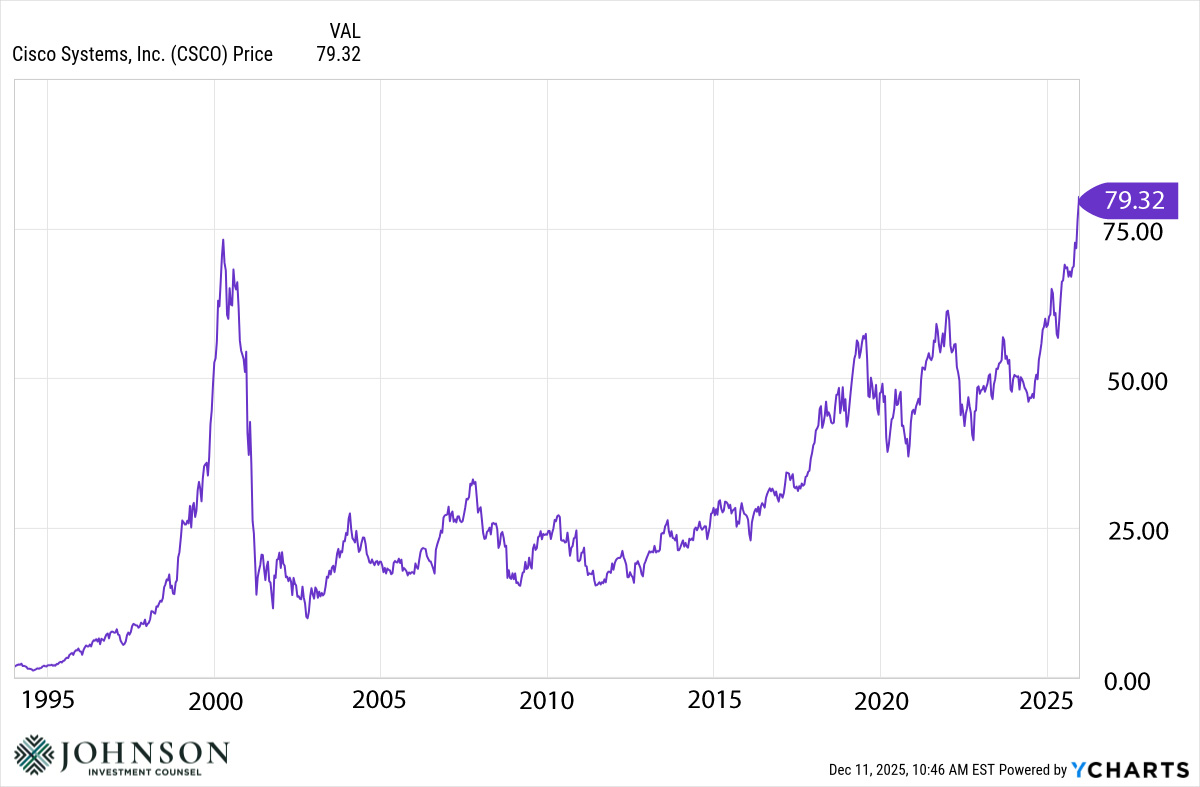

- Revisit Asset Allocation: As most know, the US large cap stock market continues to be dominated by very large and profitable technology companies. For the last couple years, we heard about the “Magnificent 7” (Meta (Facebook), Amazon, Alphabet (Google), Apple, Tesla, NVIDIA, and Microsoft) and how they represented a disproportionately large percentage of the S&P 500. However, markets and industry trends evolved in 2025. Now, we hear about the “Hyperscalers,” which are several of the same companies. This includes five companies that are spending enormous amounts of their prodigious free cash flow on building out AI infrastructure, making the bet that AI will drive a productivity leap similar to the Internet. These companies are NVIDIA, Microsoft, Meta, Alphabet, and Apple, and they continue to comprise a large portion of the S&P 500. It is estimated they currently represent about 26% of the 500 stocks in the S&P 500, as of mid-December 2025. This isn’t the first time we’ve experienced such a “top heavy” market, and history is our guide. It’s likely these five stocks could revert to the mean and underperform the broader market at some point, as expectations for future earnings are sky high. Many of us remember the poster child of internet stocks, Cisco Systems (CSCO). Back in the late 1990s, CSCO could do no wrong, and the stock peaked at around $82 in March of 2000. Despite the tech-market crash, Cisco continued to grow revenues and profits over the decades, but the expectations at the time were just too high, and the stock price sold below $10 in 2002. Fast forward over 25 years and CSCO remains a great company, with profits 5x what they were in 2000. But it took until this month, December 2025, for CSCO stock to fully recover. This is, by no means, a prediction of what will happen to today’s highly-valued tech names, just a cautionary tale and one to consider in the context of a personal portfolio strategy. Even though these are great and profitable companies, what’s most relevant is whether they can fulfill the expectations implied by their stock price. So, this might be a good time to ensure portfolio exposure isn’t too heavily weighted either with holdings of the individual shares or within the context of an index or tech heavy mutual fund or ETF.

- Check for Idle Cash: A silver lining to the higher interest rates from the last few years is the opportunity to actually earn interest on savings and money market accounts. Having cash “collect dust” in accounts without earning interest wasn’t a big deal when these accounts were paying 0.01% per year. But with money markets, CDs, and some savings accounts paying 3% or more, leaving cash in low interest accounts is leaving real money on the table.

- Calculate Employer Stock Exposure: Similar to over-exposure to the Hyperscalers, those whose compensation includes some form of company stock (directly or through 401(k) matching), should check for overconcentration of employer stock. Working for a great and successful company is no doubt a blessing, but over-exposure to the success or failure of their employer can come in two forms: a paycheck and equity holdings. It’s a good rule of thumb to limit such exposure to 5-10% of net worth, if possible. If exposure is higher, consider paring down and diversifying these positions to maintain a well-diversified portfolio.

Tax Planning Checklist:

- Harvest Capital Losses in Taxable Accounts: Before year end, revisit taxable investment accounts and consider selling positions with unrealized losses. By doing so, one can reduce, or even completely offset, realized capital gains income or deduct up to $3,000 in losses. It’s also a good idea to refer to last year’s tax return to look for capital loss carryforwards that can be used in the current tax year.

- Consider Year-End Catchup Contributions to Max Out Retirement and Health Savings Accounts: Different retirement plans have different deadlines, but, in general, contributions to employer-based plans (i.e. 401(k)) are constrained to the calendar year. So, before year end, check to see if there’s still “room” to contribute and reduce taxable income. For the 401(k), employees can contribute up to $23,500 in 2025, and if over 50 years old, an additional $7,500 can be contributed. In addition, those between the ages of 60-63 can contribute an extra $11,250 in 2025. For IRAs, it’s $7,000 and $8,000 for those over 50. For individual IRAs and some other plans for the self-employed (Solo 401k, SEP, SIMPLE), this deadline is generally before the tax filling date in April 2026.

- Check Mutual Funds in Taxable Accounts for Upcoming Distributions: Before year end, mutual funds will publish expected capital gains distributions, which could be paid out as capital gains before year end. Sometimes this happens so late in the year, there is little to be done to offset this gain, causing higher taxable income. This is a good time to check your fund holdings in taxable accounts to estimate how much, if any, will be paid out as taxable capital gains income before year end.

- Itemizing Again a Possibility: Among many changes with The One Big Beautiful Bill (OBBB), passed in July 2025, the temporary increase in the cap of deductibility for state and local taxes (SALT). Starting this year, all taxpayers can deduct up to $40,000 for state and local taxes, which is up from $10,000 but subject to income phaseouts above $500,00 of AGI. For some people with high tax bills, this higher cap could easily push them over the standard deduction of $31,500 (MFJ) and could result in the taxpayer having to add up mortgage interest, charitable contributions, and medical bills, among other Schedule A deductions, to see if they qualify for the higher deduction.

- Think Charitably:

- The OBBB also brought two notable changes for charitable giving, starting in 2026. In short, 2025 might be a great year for generous high earners to pull forward charitable contributions from 2026 to 2025. The reason is that charitable contributions in 2026 will be subject to a 0.5% AGI “floor” before they’re eligible to be deducted. This means a family who donates $30,000 with an AGI of $800,000 (and assuming they itemize) in 2026 would not be able to deduct the full $30,000 but instead would see the deduction reduced to $26,000 ($30,000 less 0.5% of AGI or $4,000). In addition, if a family is in the 37% top federal bracket, they would have their donation future limited to only 35% with the new law, not the full 37% benefit. So, the tax benefit would be reduced to $9,100 instead of $9,620.

- If a taxable account contains some “winners” from the aforementioned big tech melt up and one is charitably inclined, this could be a good year to open or fund a Donor Advised Fund with these low basis holdings. (Note: donating appreciated shares requires the shares held for one year to maximize deductibility of the value.) Donating appreciated stock from taxable accounts comes with two benefits: the tax deduction on the amount of the gift and the ability to avoid paying capital gains tax on those positions in the future. (Note: Deductibility assumes itemizing deductions.)

- Consider using Qualified Charitable Distributions (QCDs) from an IRA if age 70 ½ or older. This can reduce taxable income associated with RMDs without having to itemize deductions. It also utilizes tax deferred assets for charity (instead of liquid cash) and lowers the IRA balance, thereby lowering future taxable RMDs.

- Do the Math on Roth Conversions: We are always on the lookout for low-income years, especially with recent retirees entering what we call The Golden Window of Tax Planning in our blog from 2021. We believe this period prior to RMDs and Social Security claiming, but after retirement, is a great time to leverage the low-income year to “fill up” the lower rate tax brackets by converting a portion of tax deferred assets to a Roth IRA and paying the lower rate. These “low income” years could be an opportunity to voluntarily pay lower rates on the converted funds as future RMDs loom. For additional detail check out our blog from May 2020 which dives in to the advantages, disadvantages and pitfalls of such a strategy.

Estate Planning Checklist:

- Review Beneficiary Designations and Asset Titling: The most basic estate planning practice is as simple as ensuring the beneficiaries on various accounts are up-to-date and accurate. Simply making a list of accounts, then confirming the appropriate primary and contingent beneficiaries, can be the foundation of any well-structured estate plan. Without these simple designations, these accounts could require probate court after the account owner’s death. Probate court costs, delays, and administrative headaches are an unwelcome surprise in what is already a difficult time for those dealing with the death of a loved one.

- Revisit the Roles in the Estate Plan: In addition to beneficiary designations, it’s also a good idea to revisit who is listed in the various roles in estate planning documents. These roles include trustees for a trust, executor for wills, agents for health care power of attorney or durable (financial) power of attorney. Are these people still willing and able to serve these roles? Do you still have a trusting relationship? Are they still alive? Updating these names is a simple process that can avoid big headaches upon death.

- With Trusts & IRAs, Consider A Meeting with Your Estate Planning Attorney: In what seems like ancient history, the SECURE Act (passed in December 2019) limited the ability to “stretch” distributions of inherited IRAs. This could have impaired a well-thought-out estate plan with respect to trusts, so it’s a good idea to consult with an attorney on how the plan may have been impacted by this new law.

Retirement Reality Check:

- Spending vs. Assets: In the simplest of terms, potential retirees need to know if their assets will fund their spending and legacy goals. Of course, this requires a deep dive into spending pace, market assumptions, appropriate asset allocation, retirement income analysis, and tax analysis. Taking a fresh and brutally honest look at spending could be the single most important step a family can take when assessing their retirement readiness. For most, it’s tedious and frustrating to track down all the bills and spending, but spending relative to assets, in our opinion, is the single most impactful predictor of a successful retirement.

- Re-Prioritize Our Time: The close of the calendar year and the fresh start to the new year is a great time to reassess priorities and the value of our most limited yet unknowable asset: our time. For many a lifetime of working, saving, raising kids, and building a career or a business could have resulted in substantial assets and retirement income. Instead of thinking of retirement as “someday,” could it be time to finally get clarity on when and how retirement can be a reality? The most impactful realization might be recognizing the value of our time and how we could be spending our remaining years with friends and family.

Published 12/16/2025

Johnson Investment Counsel, Inc. (“JIC”) is an independent and privately owned investment advisory firm registered with the Securities and Exchange Commission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors prior to taking any action. Some of the comments, scores and probabilities in this presentation are based on current management expectations and are considered “forward-looking statements”. Actual future results, however may prove to be different from our expectations. Our opinions are a reflection of our best judgment at the time this presentation was created, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise. To determine if the strategy presented is appropriate for you, carefully consider the investment objectives, risk factors, and expenses before investing. Individual account management and construction will vary depending on each client’s investment needs and objectives.